tax exempt resale certificate ohio

The seller may be required to provide this. Steps for filling out the Ohio Sales and Use Tax Exemption Certificate.

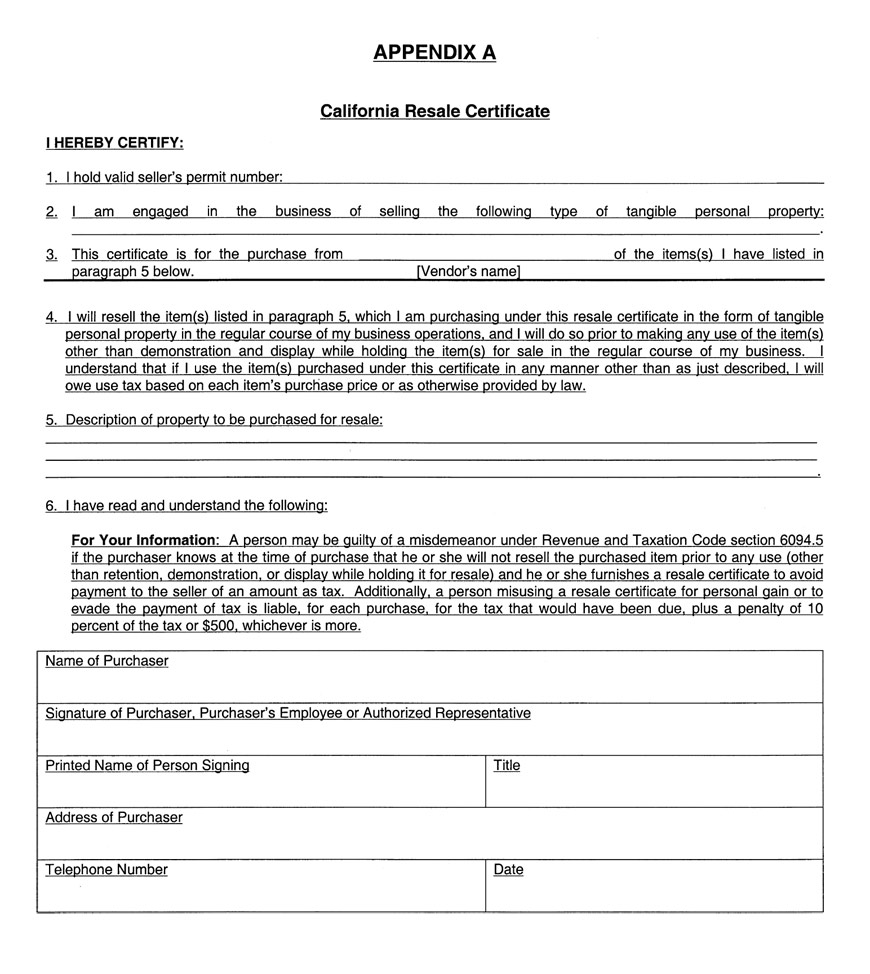

Sales And Use Tax Regulations Article 16

How to make an electronic signature for your Tax Exempt Form Ohio online.

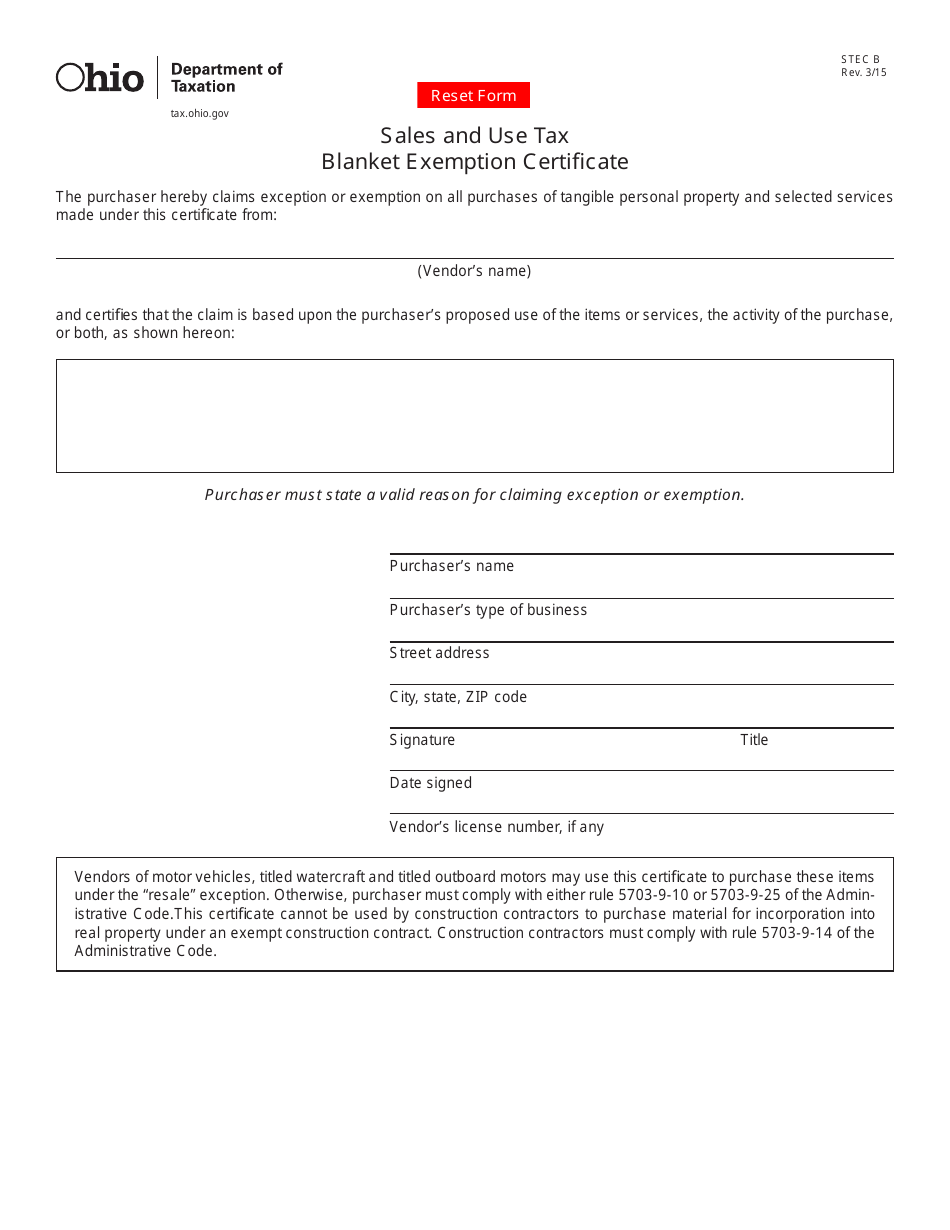

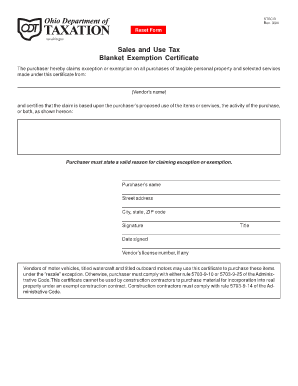

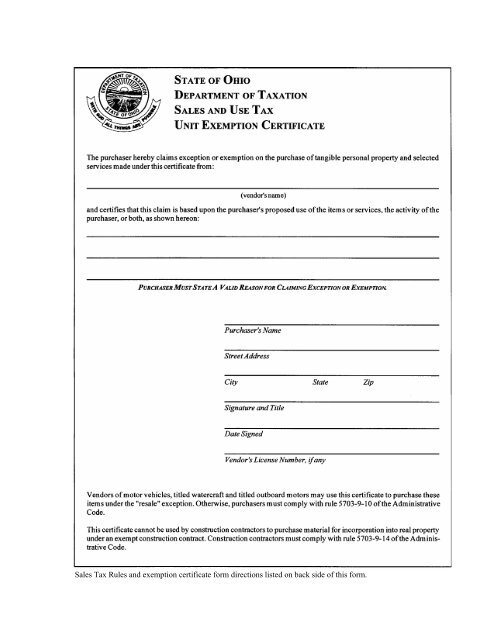

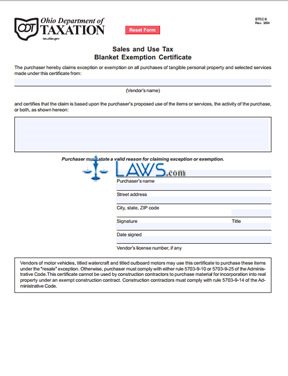

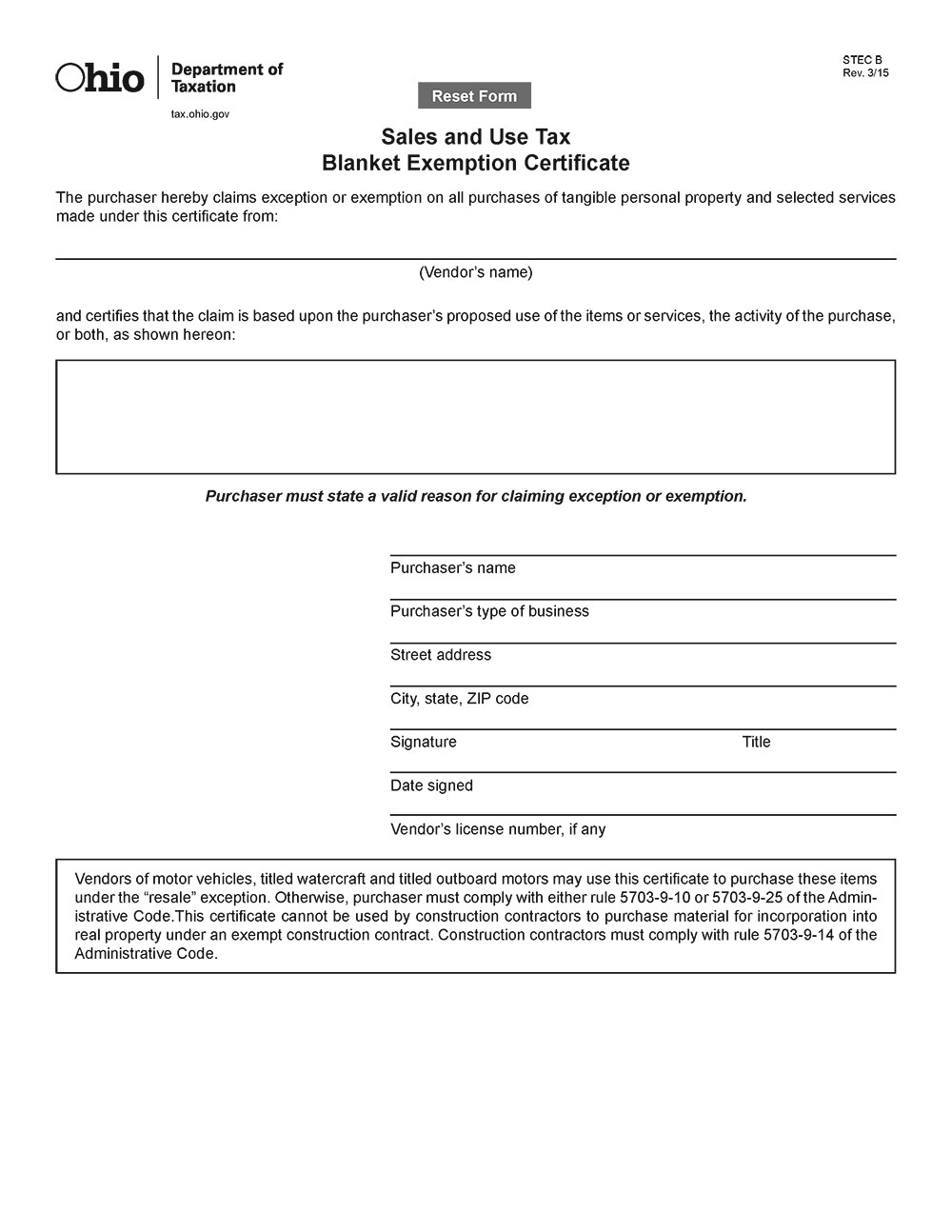

. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services. Ad Download Or Email STEC B More Fillable Forms Register and Subscribe Now. The vendor must retain the fully completed exemption certificate in its files.

This certi fi cate cannot be used by construction contractors to. STATE OF OHIO DEPARTMENT OF TAXATION SALES AND USE TAX BLANKET EXEMPTION CERTIFICATE The purchaser hereby claims exception or exemption on all purchases of. A tax-exempt resale certificate that a business holds only allows it to withhold sales tax on eligible goods and services.

Under the resale exception. Find The BestTemplates at vincegray2014. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that would otherwise be due tax on this sale.

An Ohio resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to. SignNow combines ease of use. The fully completed exemption certificate is provided to the seller at the time of sale or within 90 days subsequent to the date of sale.

Another closely related permit is an Ohio resale certificate -also known as a sales tax exemption certificate- which grants your business the benefit of being able to buy goods without paying. Otherwise purchaser must comply with either Administrative Code Rule 5703-9-10 or 5703-9-25. Step 1 Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single.

Ohio Sales Tax Exemption Resale Forms 3 PDFs. Ad 1 Fill out a simple application. Are you looking for a one-size-fits-all solution to eSign ohio resale certificate.

However when such a business with a tax-exempt resale. The exemption certificate may be provided electronically or in hard copy. Step 2 - Enter the vendors name.

Step 1 - Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction or STEC B for multiple transactions. If you are a retailer making purchases for resale or need to make a purchase that is exempt from the Ohio sales tax you need the. Sales and Use Tax Blanket Exemption Certificate.

Ohio Sales And Use Tax Blanket Exemption Certificate Stec B Free Download 2022 by kelleytremblay. The seller did not fraudulently fail to collect the tax due. In Ohio you need to complete and present an Ohio Sales and Use Tax Blanket Exemption Certificate to the merchant from which you are buying the products to be resold.

2 Get a resale certificate fast.

50 How To Start A Woodworking Business Pdf Best Paint For Wood Furniture Check More At Ht Sample Resume Cover Letter For Resume Downloadable Resume Template

Form Stec B Download Fillable Pdf Or Fill Online Sales And Use Tax Blanket Exemption Certificate Ohio Templateroller

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Ohio Tax Exempt Form Example Fill Online Printable Fillable Blank Pdffiller

Ohio Tax Exempt Form For Farmers Fill Online Printable Fillable Blank Pdffiller

Ohio Resale Certificate Pdf Fill Online Printable Fillable Blank Pdffiller

How To Get A Resale Certificate In Texas Startingyourbusiness Com

Ohio Tax Exempt Form Holland Computers Inc

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Printable Ohio Sales Tax Exemption Certificates

Free Form Sales And Use Tax Blanket Exemption Certificate Free Legal Forms Laws Com

Ohio Resale Certificate Trivantage

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com